Aug 13, 2025

Amanda Jacob

Beverage-Only QSRs: How 7 Brew, Dutch Bros & Scooter’s Are Winning

Contents

Fast. Focused. Frictionless.

That’s the formula fueling the explosive growth of a new breed of quick-service brands: beverage-only QSRs.

While traditional chains chase complex menus and new LTOs, drive-thru-only drink brands like 7 Brew, Dutch Bros, and Scooter’s Coffee are quietly rewriting the rules—and winning.

In this year’s QSR 50 Report, all three brands posted jaw-dropping growth:

7 Brew doubled its footprint, adding 222 locations in a single year.

Dutch Bros now clocks in at over 900 units, up 28.6% year-over-year.

Scooter’s Coffee added 154 units and is pushing past the 800-store mark.

What’s driving this surge? And what can other multi-location brands learn from it?

Let’s break it down.

Small Box. Big Margins.

Beverage-first QSRs run on minimal real estate and maximum output.

A typical 7 Brew is around 500–800 square feet. No seating. No dine-in. Just drive-thru lanes and hustle. That means lower build costs, faster opening timelines, and faster returns.

Without the complexity of kitchens or full-service menus, these brands simplify operations—and amplify margins.

In other words: Less square footage, more throughput, fewer headaches.

Why Drinks Make Better Economics

Beverages have always had some of the highest profit margins in foodservice. But the new beverage QSRs take it further:

Customizability → Endless flavor combos = higher ticket averages

Speed of service → Under 60 seconds per order in some stores

Frequency → Coffee and energy drinks are daily habits, not occasional splurges

It’s not just about caffeine. It’s about ritual.

Brands like Dutch Bros have turned drinks into community culture, especially among Gen Z and young families.

The Loyalty Flywheel

Loyalty isn’t optional when your product is this habitual.

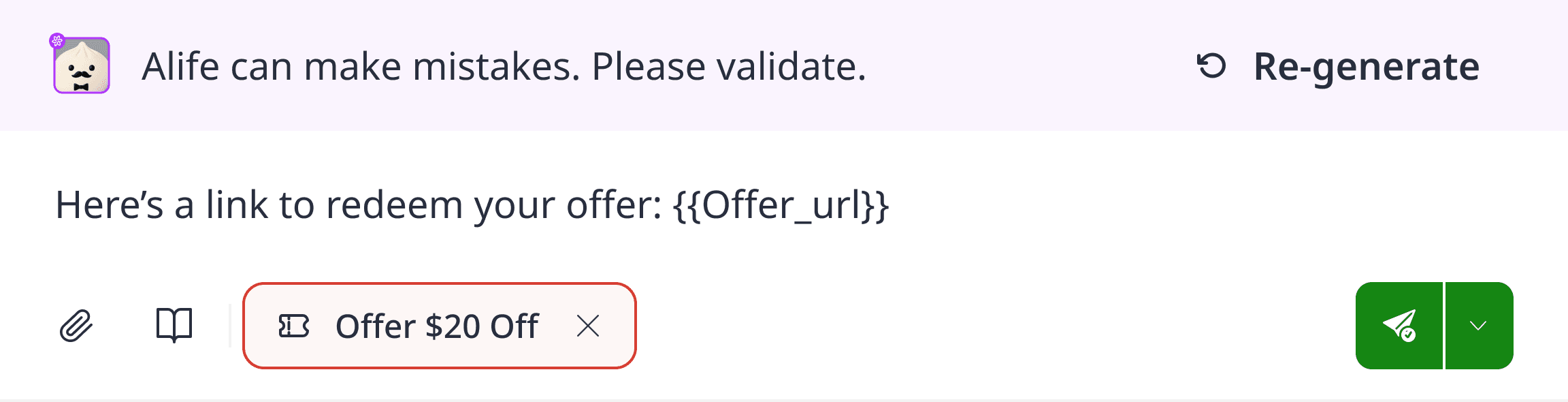

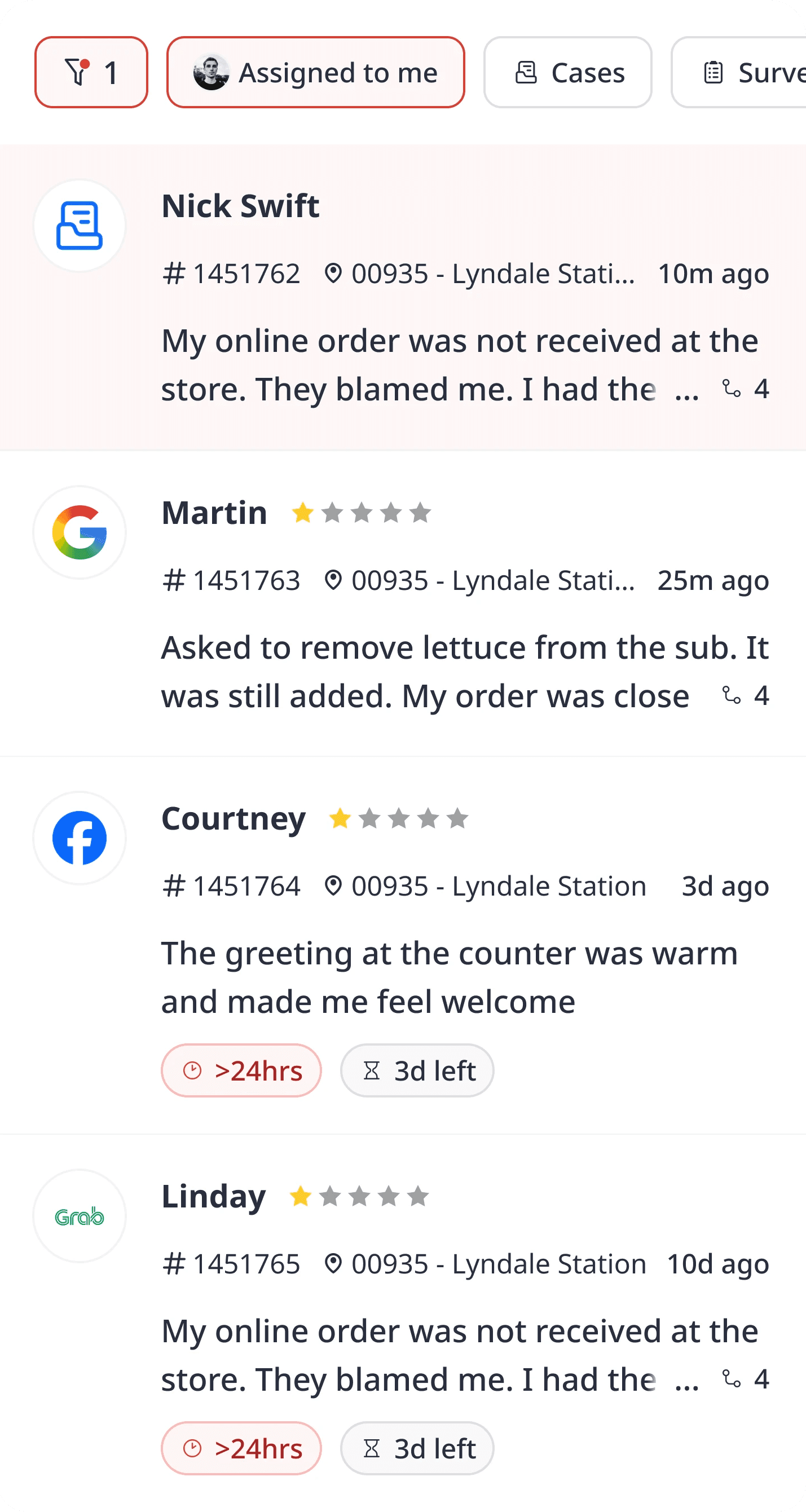

All three brands invest heavily in app-driven loyalty, text marketing, and repeat order incentives—and they’re seeing the payoff.

Dutch Bros Rewards is one of the most used coffee loyalty apps in the U.S.

7 Brew offers a points-based program with instant rewards, built into the mobile ordering experience

Scooter’s drives local store volume with digital rewards and neighborhood-specific offers

These aren’t “bonus” programs—they’re revenue channels.

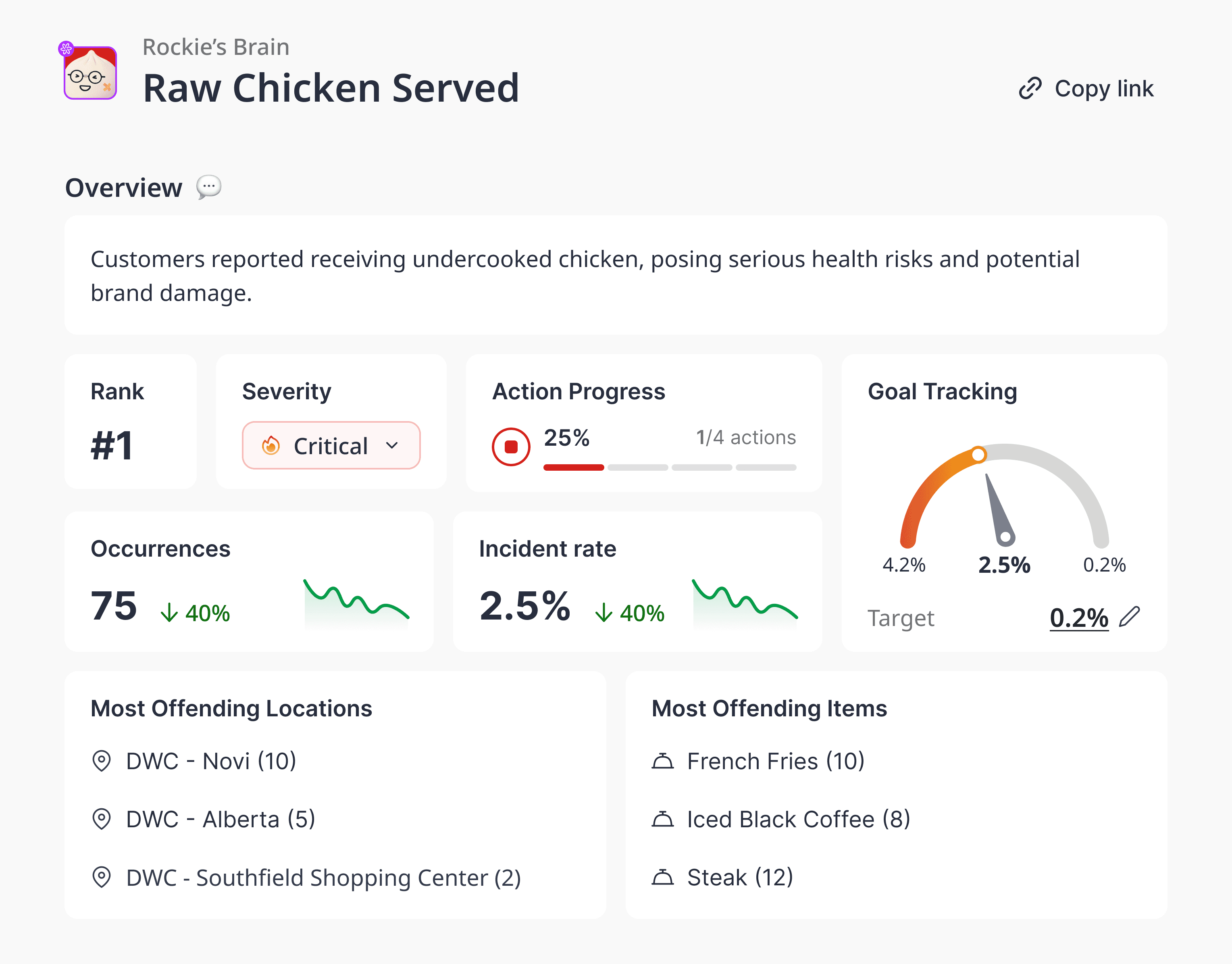

Culture Drives Compounding Growth

This category isn’t just winning on unit count. It’s winning on brand love.

Drive-thru beverage QSRs recruit teams with energy and optimism. They script smiles into every order interaction. They don’t just serve drinks—they serve vibes.

That culture has created an army of loyal fans and operators.

If you're expanding as a multi-location brand, here’s what that means:

Culture isn’t just internal—it’s a growth strategy.

What Other QSRs Can Learn

Nail the unit economics first

→ A great small-format store can outperform a bloated full-service locationTreat loyalty as infrastructure

→ Every daily product needs a frictionless repeat journeyDesign for rituals, not just cravings

→ Winning products fit seamlessly into daily lifeScale brand experience with ops, not just marketing

→ When your service model is consistent, your brand becomes exponential

Final Sip

There’s a reason Wall Street and franchise operators are watching this category closely. With lower build costs, higher frequency, and insanely loyal customer bases, beverage-only QSRs might just be the smartest growth model in the industry right now.

If you’re looking to scale, simplify, or enter new markets, you might not need a whole new menu.

You might just need a better drink strategy.