Aug 12, 2025

Amanda Jacob

Why Chick-fil-A Makes $9.4M Per Store And What We’ve Learned

Contents

In a market where most QSR brands are racing to open more locations, Chick-fil-A is doing something different: generating more revenue from each one.

According to the latest QSR 50 Report, Chick-fil-A leads the entire industry in Sales Per Unit (SPU) with a staggering $9.4 million per store—nearly double that of other big players like Raising Cane’s ($5.4M) and Portillo’s ($5.7M).

The big question is: How?

Let’s break down what makes Chick-fil-A’s unit economics the envy of the industry—and how other QSR brands can learn from the playbook.

It’s Not About Speed. It’s About Throughput.

Chick-fil-A’s drive-thru isn’t the fastest in the industry—but it’s one of the most efficient.

They’ve mastered high-volume, high-accuracy ordering with dual-lane setups, outside order-takers, and kitchen operations that can handle lunch-rush chaos without missing a beat. Throughput, not just ticket time, is the real KPI here. They’re serving more people in less time without cutting corners.

This kind of consistency translates directly into revenue. If you're a multi-location brand, Chick-fil-A’s model should spark one clear question:

How many more orders per hour could you fulfill without increasing your headcount?

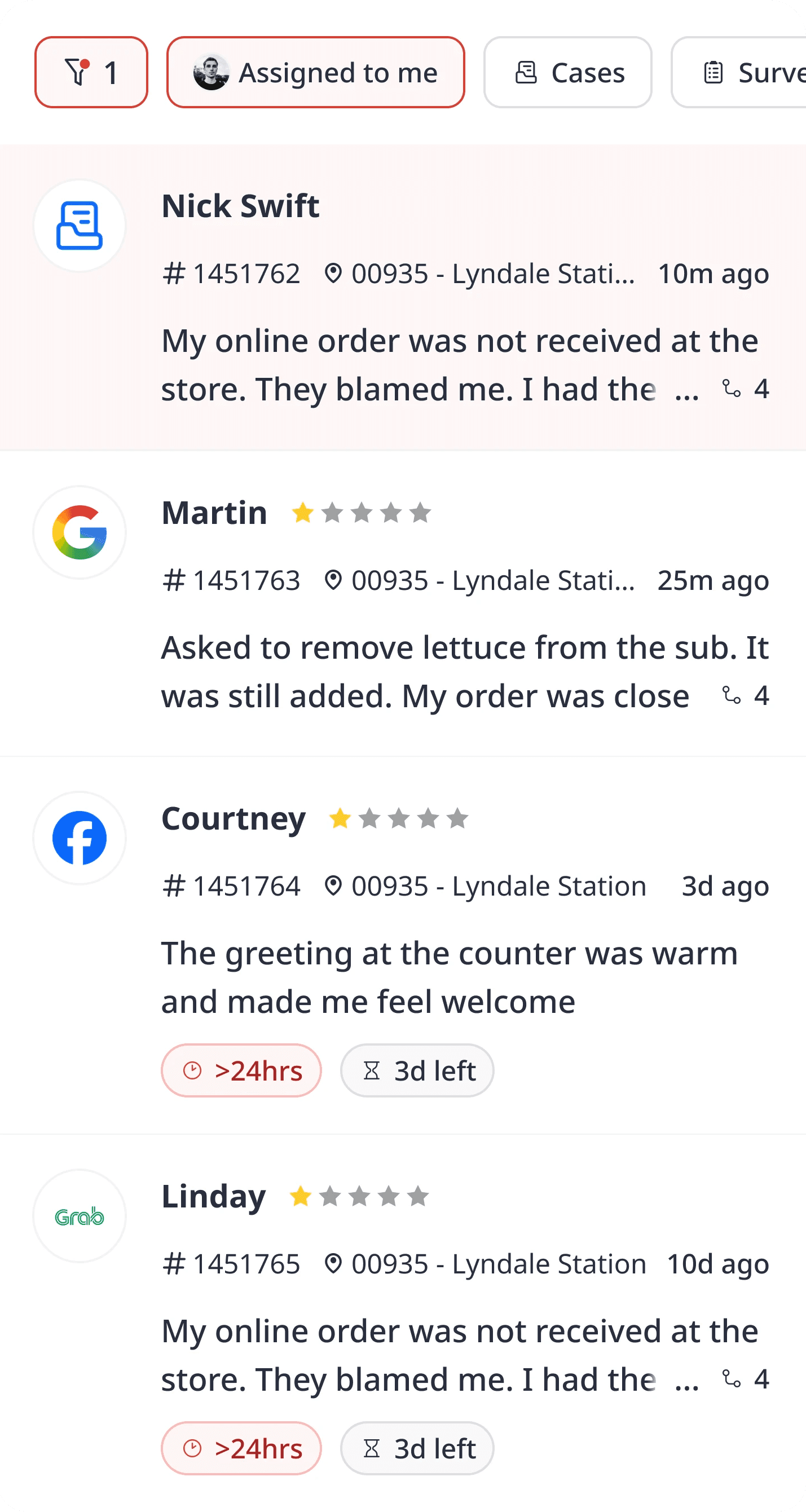

Local Ownership Drives Local Loyalty

Unlike many large QSR brands, Chick-fil-A operates on a unique franchise model with hands-on owner-operators who run just one store each.

This structure creates deep community ties, cultural consistency, and razor-sharp attention to customer experience. The result? Locations that feel personal—because they are.

And that kind of connection builds long-term loyalty and higher ticket averages. While other brands talk about customer engagement, Chick-fil-A lives it.

A Menu Built for Focus (and Profit)

Chicken, waffle fries, lemonade. That’s it—more or less.

While competitors chase menu innovation, Chick-fil-A thrives on menu discipline. Their tight SKU count leads to faster prep times, smaller kitchens, lower inventory waste, and fewer labor touchpoints per order. And all of that creates margin room.

If you're adding LTOs monthly and seeing declining ops efficiency, take note: Simplicity scales.

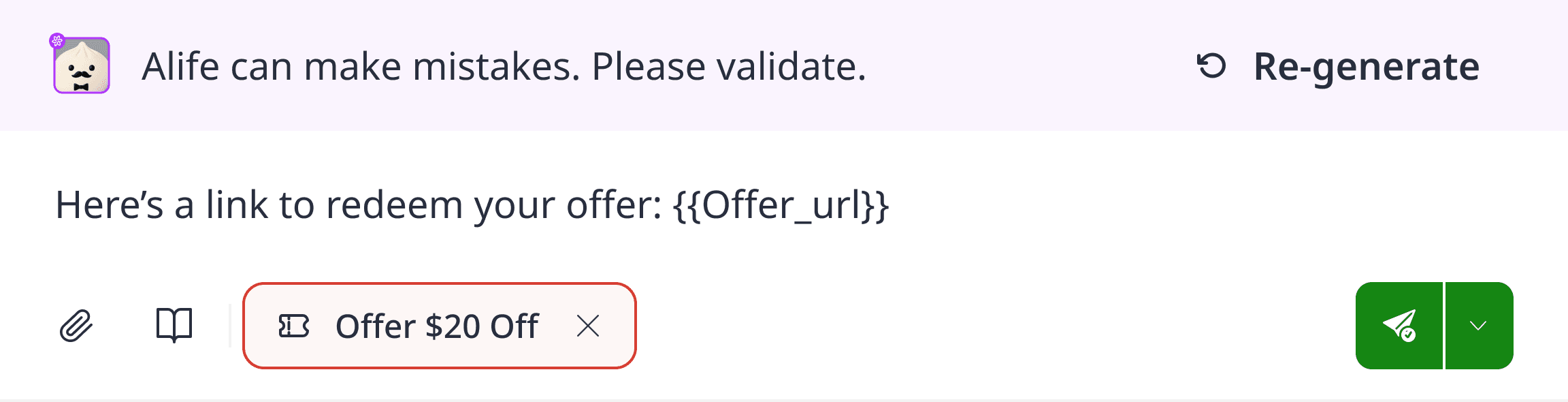

The Loyalty Loop: One App, One Ecosystem

Chick-fil-A’s app isn’t just a nice-to-have. It’s a revenue machine.

Mobile ordering cuts down on service time.

Points-based rewards incentivize repeat visits.

Direct comms mean fewer dollars spent on third-party ad platforms.

Most importantly, their loyalty app collects first-party data that informs everything from store layout to upsell prompts. It’s a closed-loop system—and it works.

How to Apply This to Your Brand

You don’t need to be Chick-fil-A to think like Chick-fil-A. Start with:

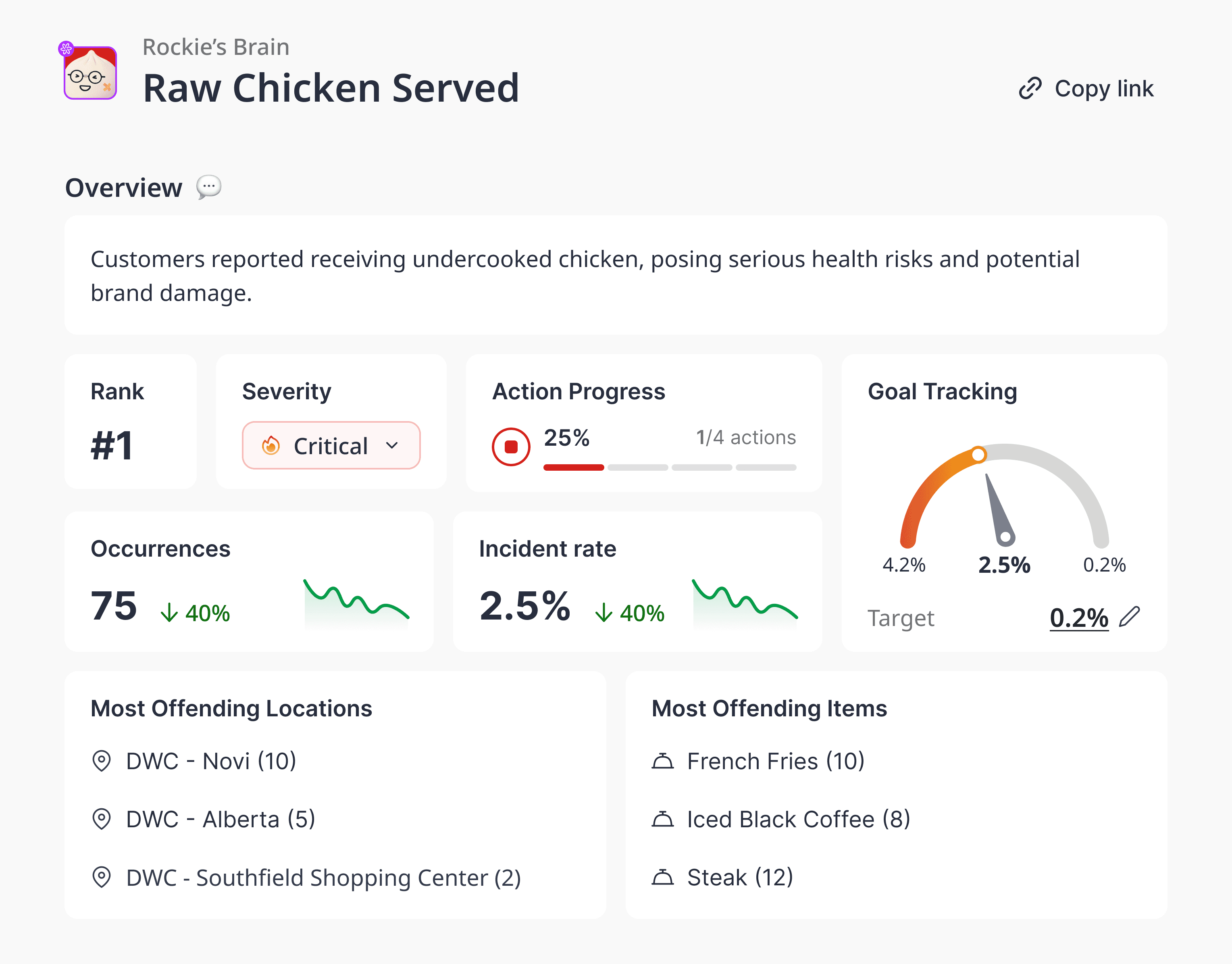

SPU as a core KPI: Stop measuring success by unit count alone. Prioritize profitability per store.

Simplify your menu: More options often mean more complexity, more mistakes, and lower margins.

Tighten your ops: Run time-and-motion studies. Where are you losing speed? Where can AI or automation help?

Invest in loyalty, not just promotions: Build a first-party ecosystem. The returns will outpace discounts.

Why It Matters for the Future of QSR

As rent, labor, and marketing costs rise, volume per store will make or break chains.

Chick-fil-A’s $9.4M benchmark isn’t just a bragging right. It’s proof that modern QSR growth isn’t about how wide you can go—it’s about how deep you can win in each location.

That’s the future. And it’s one every brand can build toward.